アベノミクス: Abenomics in Japanese

PDF File: “Will ‘Abenomics’ Save the Japanese Economy?” by Kim Sang Keun

I. Introduction

Ever since Shinzo Abe came to power, the Japanese government led by LDP has vowed to revive the stagnant economy by implementing bold economic policies. In effort to overcome so-called ‘Lost Decades,’ which has deteriorated the ego of many Japanese people, Abe has announced three simple economic policies that earned the name ‘Abenomics’ after its proposer. This includes indefinite quantitative easing, flexible public finance policy and economic growth strategy.[8] In this paper, we will look at the economic logic behind the Abenomics and problems and risks associated with it.

II. Economic Logic Behind Abenomics

Through Abenomics, the Japanese government hopes to revive its economy by implementing bold, powerful economic policies that will pull its economy out of deflation, depreciate Japanese yen, and induce CPI inflation rate of 2% per year. The Japanese government saw the constant decline of overall price level by lack of aggregate demand as the main culprit of the long-term recession that its country was going through.[3] In order to ‘reflate’ its economy, Abenomics tries to implement quantitative easing, fiscal policy through expanding government spending, and provide economic growth strategy. We will first look at the quantitative easing and its economic theory behind what the Abenomics is trying to achieve.

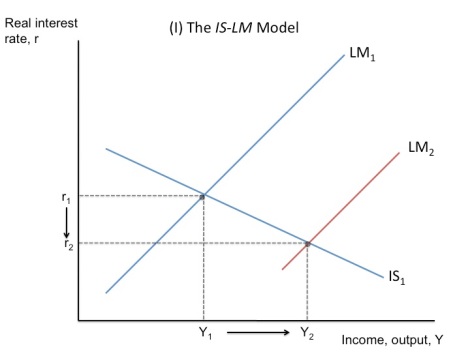

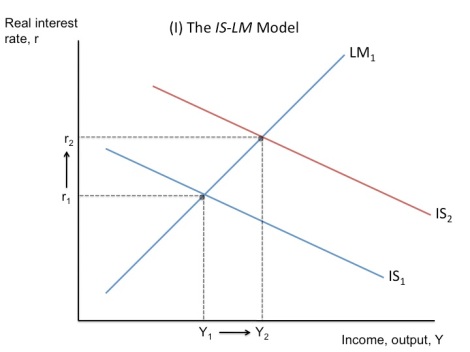

For analyzing the economic theory of Abenomics, the Mundell-Fleming Model for a large open economy was used in this paper as the main model. The following are the IS-LM equations for the model:

IS: Y = C(Y-T) + I(r) + G + NX(e)

LM: M/P = L(r,Y)

Notice that the assumption of r = r* was dropped, which is an equation for a small economy that cannot influence the world interest rate. As Japan is the third largest economy in the world, the assumption that it has little influence on the world financial market had to be dropped. Therefore, the interest rate was treated as an endogenous variable. As a result, LM curve got a positive slope, instead of being vertical.

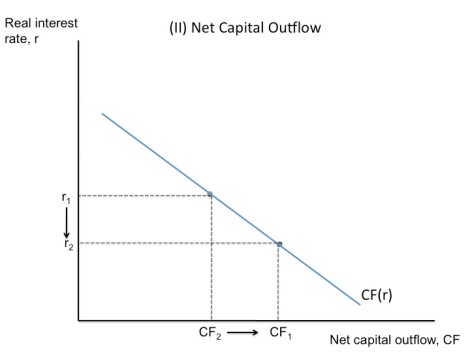

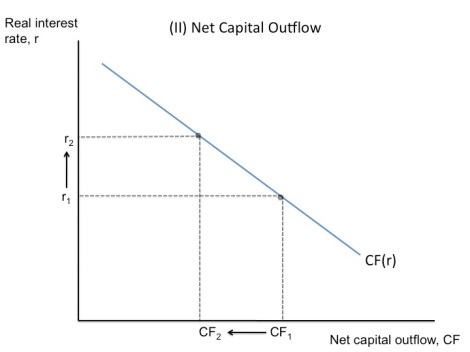

First of all, the Bank of Japan is targeting a 2% CPI inflation rate and increasing the money supply circulating in the economy by buying various financial assets such as the government bond, which is essentially monetary expansion policy.[3] It could be said that this indefinite quantitative easing is the core of Abenomics. On the graph above, the increase in the money supply shifts the LM curve to the right, raising the income from Y1 to Y2, and lowering the real interest rate from r1 to r2. The decrease in the real interest rate then increases the net capital outflow as is illustrated on the second graph.

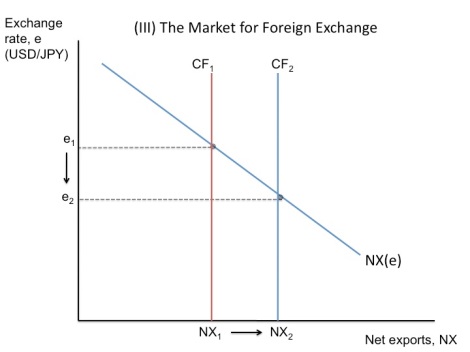

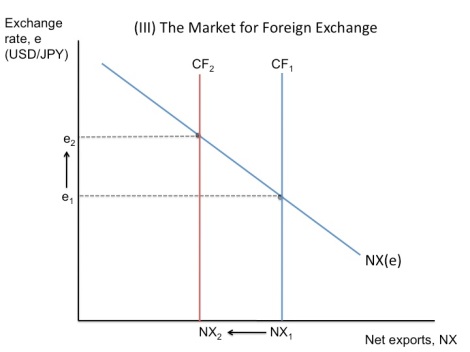

As the net capital outflow increases from CF1 to CF2, the supply of Japanese yen in the market for foreign exchange increases. The exchange rate falls from e1 to e2, depreciating the Japanese yen. This makes the Japanese goods relatively cheaper to foreign goods and the net export rises from NX1 to NX2. There are two channels for this mechanism. First, as the monetary expansion lowers the interest rate, this stimulates the investment. Second, as the monetary policy causes the currency to depreciate in the market for foreign exchange, this stimulates net exports.

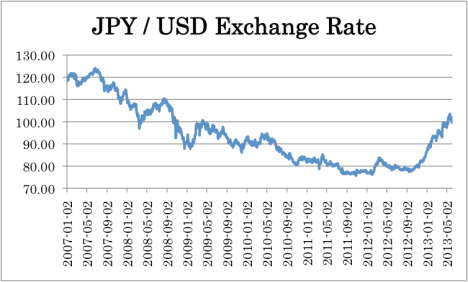

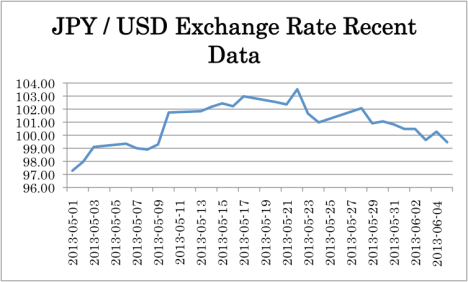

All in all, the Abenomics tries to devaluate its allegedly over-appreciated yen and cause an inflation rate of 2% as the output increases. As a result, the Japanese yen has depreciated until the 103.42 (JPY/USD) recently on May 22nd. This is the lowest in almost 6 years, ever since the Global Financial Crisis that hit the economy around the world in 2007. This is shown in the exchange rate graph above.

Secondly, the Japanese government is trying to initiate fiscal policy by expanding government expenditures. As the government implements fiscal expansionary policies the IS curve shifts to the right. As the graph above illustrates, this shift in the IS curve leads to an increase in the level of income from Y1 to Y2 and an increase in the interest rate from r1 to r2. The increase in the real interest rate reduces the net capital outflow from CF1 to CF2.

As the net capital flow falls, the supply of Japanese yen in the market for foreign exchange falls. This induces the exchange rate to appreciate from e1 to e2, which decreases the net export from NX1 to NX2 as the Japanese goods become more expensive relative to foreign goods.

As the graph illustrates, the fiscal expansion by Abenomics will raise the income and output for the Japanese economy. However, it is to be pointed out that although implementing both the fiscal and monetary expansionary policies will increase the output of the Japanese economy, the effect on the exchange rate is conflicting. Yet, this problem is accounted for as the Japanese government will set its ‘desirable’ exchange rate, possibly above 100 JPY/USD, and fix it so that other variables can freely adjust, although it might compromise some of the output to some degree. Or if the Japanese government considers the increase in the economic output, and therefore the inflation rate, more important over the exchange rate, it might decide to compromise fixating the exchange rate to their ‘desired’ level for the economic growth.

Thirdly, on June 5th, the Japanese government announced the third policy for Abenomics, which includes economic growth strategy. The government announced plans for bringing up the financial integrity of Japan, however, there were no significant policies that were announced.

III. Problems and Risks Associated with Abenomics

There is a rising skepticism towards whether Abenomics would really revitalize the Japanese economy as the exchange rate appreciated breaking the 100 JPY/USD boundary and as Nikkei Index crashed. Although, theoretically, Abenomics has a sound Keynesian background, many are pointing out the fact that it is too focused on the demand side of its economy, not on the supply side.

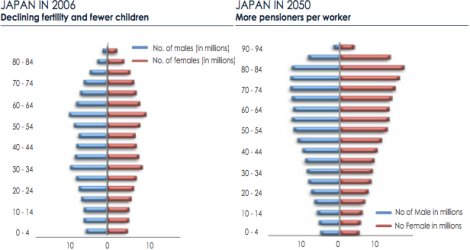

Japanese Demography Data[11]

One of the fundamental problems that Japan is facing is its ageing population. As the population pyramid gets inverted, the labor population is shrinking every year. This brings about number of problems for the Japanese economy. First, the government commitment in spending on pensions, medical expenses and social security will continually act as a substantial burden to the already indebted country with a public debt of 240% its GDP.[11] This will further worsen the financial integrity of the Japanese government leading to an erosion of international confidence in Japanese economy. The lack of confidence can raise the risk premium (CDS) shifting the IS* curve to the left and LM* curve to the right, as θ increases for r = r* + θ. But, the exchange rate would depreciate more than what is desired by the Japanese economy, and it would force the Bank of Japan to decrease the money supply in order to bring up the yen value, shifting the LM* curve back to the left. This would aggravate the situation and lower the total income in the Japanese economy. This then would induce the interest rates to depress the prices of financial assets, which will then reduce the collateral being used as bank loans. As a result, this will lead to financial problems for Japan, further exacerbating the problems. Secondly, its dwindling workforce cannot sustain the economic output level that is maintained in the future.[11] As it is shown on the data, the demography will drastically change so that more young people will have to support for the older population, which implies that this change in demography is the main culprit for the last two decades of deflation and stagnant economic growth.[11] This has another implication to why the consumer demand might be falling behind.

In this sense, it could be said that Abenomics is failing to address the core problem of its economy. It must ask why consumer demand is inherently weak. Another major reason why the Japanese economy is stagnating is the poor productivity. This may sound strange to many people as Japan was once praised as technologically advanced country. However, according to the statistic, Japanese productivity lags badly behind world’s leading countries in many areas. For example, it lags 30% behind the U.S. in manufacturing with automobiles industry in exception.[9] Therefore, corporate reforms are needed in order to let inefficient firms downsize or die and be replaced to better ones.[9] In the case of Korea, as it suffered trough the so-called IMF Crisis in 1997, it underwent painstaking corporate reforms to let the inefficient firms die and raise the overall competitiveness of its economy. So it is doing relatively fine in terms of corporate competitiveness and financial integrity compared to Japan, although this is shaking a little due to Abenomics.

What is problematic right now is that the third policy for Abenomics lacks fundamental and specific content, which started to give erode out public confidence in Abenomics. As it was mentioned, this resulted in the crash of Nikkei Index and the re-appreciation of Japanese yen, breaking the 100 JPY/USD boundary. Shinzo Abe, afraid of losing the votes, has put aside the painstaking reforms to later, such as corporate tax cuts that will improve the productivity of Japanese firms. There was a discussion within the Japanese government in cutting the corporate taxes from 30% to 20% and to implement new policies that will make the labor market flexible.[5] However, flexible labor policy means temporary job losses[11], and it seems that Shinzo Abe is putting these essential reforms after the Japanese upper house elections. This could erode out confidence in Abenomics losing its force towards reviving the economy.

There is another risk associated with Abenomics. As the yen depreciates, net export increases as domestic products gets cheaper abroad, however, imports get more expensive. This is a big problem for Japan as ever since the Fukushima nuclear disaster, the word ‘energy crisis’ was lingering around the Japanese newspapers for two years. As Japanese public refused to use nuclear power, the Japanese government had to turn to more expensive imported energy, such as LPG, oil and naphtha, increasing the monthly value of Japanese energy imports from 1.4 trillion yen to 2.2 trillion yen.[12] This could deteriorate the competitiveness of Japanese companies, as energy prices go up. In addition, export accounts for only about 14% of its economy.[1] So the core of Abenomics should be in order to revive the domestic economy, not through export. The increase in energy prices could raise the domestic consumer prices without actually improving the income of the Japanese firms and consumers. Therefore, there is a risk towards Abenomics in that expensive energy imports will drag the Japanese economy into another lost decade.

IV. Conclusion

In conclusion, Abenomics is a sound Keynesian policy that could save the Japanese economy from deflation. The Mundell-Fleming Model was used to illustrate the economic theory behind Abenomics. However, there were considerable risks associated with Abenomics, such as the ageing population, poor productivity and the energy crisis. The key to success for Abenomics would be dependent on whether the Japanese government effectively manages these risks and confronts the fundamental reforms that would improve the supply side of its economy.

Reference

1. 박영철, 아베노믹스 실패 가능성 높다, <주간조선>, 2013.03.18, http://weekly.chosun.com/client/news/viw.asp?nNewsNumb=002248100014&ctcd=C05

2. 박형준, 日 환율-주가-금리 3각 부메랑… 아베노믹스 두달만에 휘청, <동아일보>, 2013.06.05, http://news.donga.com/3/all/20130605/55643597/1

3. 이형근, 아베노믹스, 디플레이션 탈출과 엔고 시정 추진, 2013년, 평화문제연구소, 통일한국 제352호, pg34-35, http://www.dbpia.co.kr/Article/3129836

4. 정성춘, 이형근, 서영경, 일본 아베노믹스의 추진 현황과 정책 시사점, 2013년, 대외경제정책연구원, 오늘의 세계경제, Vol. 13, No. 5

5. 차학봉, 아베노믹스 세 번째 화살 ‘不發’, <조선일보>, 2013.06.06, http://news.chosun.com/site/data/html_dir/2013/06/06/2013060600263.html

6. 한영기, 아베노믹스의 효과 및 과제, 2013년, 한국은행 동경사무소

7. 한창만, 아베노믹스 ‘거꾸로 효과’, <한국일보>, 2013.02.20, http://news.hankooki.com/ArticleView/ArticleView.php?url=world/201302/h2013022021083122510.htm&ver=v002

8. Adams, W. J. (2013). Japan: Assessing the Future of Abenomics, The Boston Company, http://www.thebostoncompany.com/assets/pdf/views-insights/April13_Views_Insights_Future_of_Abenomics.pdf

9. Katz, R. (2013). Abenomics Is Bad Medicine, The Wall Street Journal, http://online.wsj.com/article/SB10001424127887324590904578287472450294546.html

10. Mankiw, N. G. (2013). Macroeconomics Eighth Edition, Macmillian

11. McNerney, G. J. (2013). Will ‘Abenomics’ Ensure Japan’s Revival?, Thomas White International, http://www.thomaswhite.com/pdf/Will-Abenomics-Ensure-Japans-Revival.pdf

12. Schaede, U. (2013). Abenomics cannot succeed without cheap nuclear power, The Japan Times, http://www.japantimes.co.jp/opinion/2013/06/05/commentary/abenomics-cannot-succeed-without-cheap-nuclear-power/#.UbFlP-uPJBy

Data

13. St. Louis Economic Research: http://research.stlouisfed.org/fred2/graph/?id=DEXJPUS

14. Naver금융: http://info.finance.naver.com/marketindex/worldExchangeDetail.nhn?marketindexCd=FX_USDJPY

15. Naver금융: http://finance.naver.com/world/sise.nhn?symbol=NII@NI225#

Taxation: A Legal Pickpocketing

Taxation: A Legal Pickpocketing